- 02 9327 4880

- Suite 11/193-201 New South Head Rd, Edgecliff NSW 2027

- contact@sfpfinancial.com.au

Your maximum borrowing capacity and the amount you should borrow are often different. Just because a bank or lender is willing to lend you a certain amount, doesn’t mean that amount is right for your individual needs. Determining your maximum borrowing capacity should be carefully assessed by looking at a number of factors including your income and individual spending habits. When looking at borrowing capacity, the two limiting factors are your savings/deposit and your available cashflow.

Example 1 – If Jenny is looking to by a $600,000 home, has no savings/deposit but has sufficient income to make loan repayments, Jenny would be unable to purchase a property as she is unable to pay for the upfront costs (deposit, stamp duty and other purchase costs).

Example 2 – If Jenny has $200,000 saved but has insufficient income, she would be unable to purchase the property. Although Jenny has enough money to pay for the upfront costs, she would be unable to make the ongoing loan repayments. In some instances, a family/equity guarantor can be used in place of genuine savings.

Stamp duty is a tax charged by the state government when purchasing a property (also known as transfer duty). The amount of tax charged can differ depending on a number of factors, including; property value, property location and available grants and/or schemes the state government offer. In NSW, first home buyers have access to the First Home Buyers Assistance Scheme (FHBAS) which provides a stamp duty exemption for first homes valued up to $650,000 and a partial stamp duty exemption for first homes of up to $800,000. To find out more above the ‘First Home Buyers Assistance Scheme (FHBAS)’, check out the latest information on the on the NSW Government Revenue – Grants and Schemes website.

A guarantor home loan allows parents to assist their children in purchasing a home by using the equity in their home or investment property in place of savings. This can assist first home buyers to get into the market sooner as the first home buyer doesn’t have to save the full 20% deposit. When a guarantor uses their equity in place of a deposit, they are essentially putting up a portion of their home as collateral so the lender will accept the loan application. As this is the case, guarantor loans need to be handled with care and all parties need to ensure they fully understand the risks involved.

Guarantor loans can be a great way for young people to buy their first home but it’s important to speak with your mortgage broker and obtain legal advice before applying for a loan.

Lenders Mortgage Insurance (LMI) is a premium charged by the lender when borrowing more than 80% of the property value (having less than a 20% deposit). LMI is not a set dollar amount and will fluctuate depending on the loan balance and the amount of deposit available.

Example – Matt wants to purchase a $700,000 home and has $70,000 saved for a deposit. A lender may accept the 10% deposit but will charge Matt an LMI fee of $15,000 due to the increased risk the lender is taking on. Many lenders capitalise the LMI fee into the loan so in Matt’s case, the total loan amount would be $630,000 + 15,000 LMI fee ($645,000)

LMI increases the loan balance which increases the interest charged by the lender so before taking out a loan with LMI, it’s important to obtain professional advice to ensure LMI is right for your individual needs.

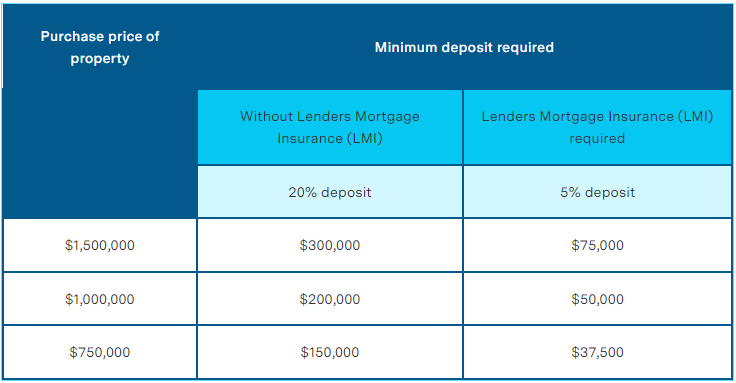

The below table provides examples of the deposit required to purchase a property. In most instances, if you’d like to avoid paying Lenders Mortgage Insurance (LMI), you’ll need a deposit of 20% or more of the property value.

You may be able to purchase a home with as little as a 5% deposit with the assistance of LMI.

|

Purchase price of property

|

Minimum deposit required

|

|

|---|---|---|

|

|

Without Lenders Mortgage Insurance (LMI)

|

Lenders Mortgage Insurance (LMI) required

|

|

|

20% deposit

|

5% deposit

|

|

$1,500,000

|

$300,000

|

$75,000

|

|

$1,000,000

|

$200,000

|

$50,000

|

|

$750,000

|

$150,000

|

$37,500

|

There’s often a lot to think about.

SFP have been assisting clients with strategic debt advice for over 20 years. Our unique difference is in our wealth of knowledge from both a mortgage broking and financial advice perspective. We’re able to assist with obtaining finance and ensure you receive the correct financial advice to make the right financial decisions in your next big move.

With 1000’s of home loan products available in Australia, it can be difficult to find the right lender and loan for your needs. Our specialist finance team works with a panel of over 30 different lenders including big banks, credit unions and non-branch lenders to ensure we find the right home loan for your individual needs.

There’s a lot to think about when moving home and it’s easy to forget the costs involved in the selling and buying process. Before putting your home up for sale or placing a deposit on a new home, it’s important to assess all the costs to ensure a smooth transition into your new home. Below are some of the costs to consider;

Property investment in Australian continues to be a popular way to build wealth over the long term but care needs to be taken when investing in property and obtaining finance for your investment property purchased.

Lenders treat investment property loan differently to standard home loans which means a different approach needs to be taken. When looking to finance an investment property, the below points

need to be considered;

Investing in property can help building wealth and generate income but property investment isn’t

without its risks. It’s important to work with professionals to ensure you’re receive the right advice

for your individual needs.

Our specialist finance team works with a panel of professionals such as accountants, solicitors and

in-house financial advisers to ensure you receive the right advice. If you’re already working with one

or all of the above, we’ll work with them to get the best outcomes for your needs.

We offer an obligation free appointment where we can openly discuss what you’re looking to achieve. We’ll be able to provide you with investment property loan options and answer any questions along the way.

We look forward to meeting you soon.

If you haven’t reviewed your current home loan lately, chances are you might be paying too much. Interest rates are at an all-time low in Australian, so there’s never been a better time to compare the market and ensure you’re getting the best deal.

SFP’s home loan specialists can assist with all your refinance needs, including;

We offer an obligation free appointment where we can openly discuss what you’re looking to

achieve and put your mind at easy. We’ll be able to provide you with refinance options and answer any questions along the way.

We look forward to meeting you soon.